Other Resources

ALL ARTICLES

RESOURCES

Help Center

Below you will find a number of topics ranging from personal to business banking.

At first glance, a checking account is a checking account. Money comes in, money goes out, and you check the balance when you need to. But the day you start running a business, the rules change, because the risk changes. Business accounts aren’t just “bigger” consumer accounts. They typically handle more transactions, more users, more payment types, and more moving parts.

There’s another key difference many owners don’t realize until it’s too late: business accounts generally do not have the same level of consumer protections that consumer (personal) accounts do. When something goes wrong, the process, timelines, and potential liability can look very different. That’s why fraud prevention for businesses isn’t optional. It’s operational.

Consumer (personal) accounts are usually simpler:

Business accounts are different by design:

And because business accounts are treated differently than consumer accounts, the responsibility to monitor activity and catch issues early often rests more heavily on the business.

Most business owners are busy. Delegating bookkeeping is smart, because your time is valuable. But delegation without visibility is where risk grows, especially when one person has end-to-end control.

Internal fraud often looks like:

It’s rarely dramatic at the beginning. It’s usually quiet, incremental, and designed not to be noticed.

Consider Lisa, who owns a growing medical practice. She hired a bookkeeper to “handle the finances” and assumed monthly reports were enough. Lisa rarely reviewed actual transactions unless something felt off.

Over time, the bookkeeper began issuing checks to a vendor that sounded legitimate. The amounts were small—$180 here, $250 there—coded as routine office supplies. The practice was busy, revenue was strong, and nothing looked “wrong” at a high level.

Six months later, Lisa’s accountant flagged unusual expense patterns during a quarterly review. By then, the total loss wasn’t a rounding error. It was meaningful, and the cleanup took time, created stress, and required uncomfortable conversations. The hardest part wasn’t just the money; it was realizing the problem could have been caught early with simple, consistent oversight.

You don’t need to become your own bookkeeper. You just need a rhythm of review that helps you spot unusual activity quickly, especially because business accounts don’t always come with the same consumer-style protections.

Try these straightforward habits:

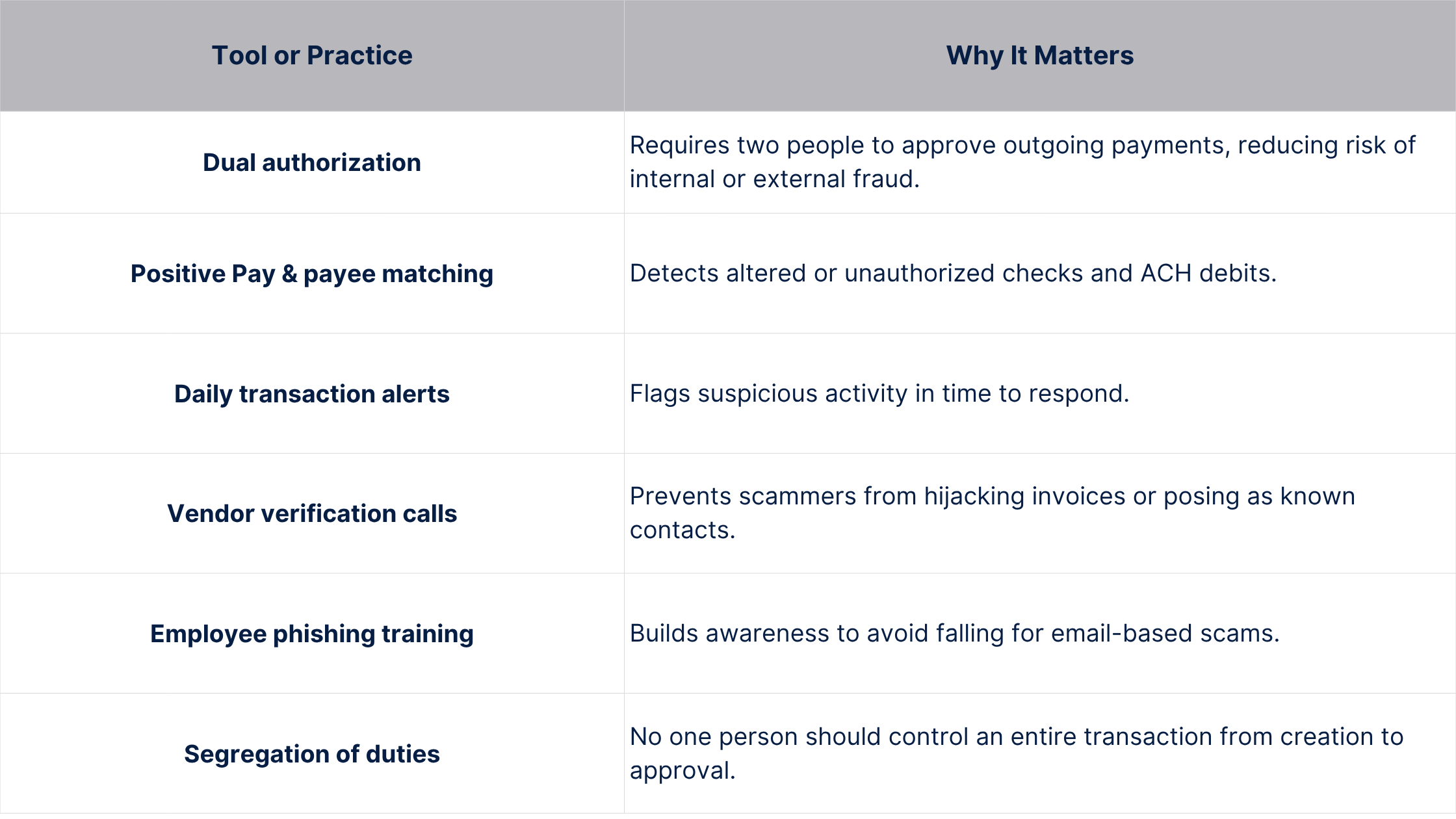

Strong habits matter, but systems are what help you scale safely. Depending on your business, ask about tools such as:

Surety Bank can help you evaluate which controls fit your operation, set permissions correctly, and implement tools like Positive Pay in a way that’s practical—not burdensome. The goal is to put guardrails in place that make fraud harder to commit and easier to catch, without slowing down your business.

Residential accounts are often simpler and tend to come with broader consumer-style protections. Business accounts operate differently—more volume, more access, more complexity, and often less built-in protection. That’s why vigilance isn’t just a best practice; it’s part of responsible business ownership.

Fraud prevention isn’t about paranoia. It’s about professionalism: review regularly, limit access wisely, and build systems that protect your business long before problems appear.

For cash-heavy businesses, deposit routines are not just an operations detail. They are a security issue, a controls issue, and often a cash-flow issue. When business cash gets deposited “personally,” meaning an owner or employee deposits cash through personal banking habits or into the wrong account, it can blur your recordkeeping and weaken internal controls. The IRS notes it is a good idea to keep separate business and personal accounts because it makes recordkeeping easier. The U.S. Small Business Administration also emphasizes separating funds by using a dedicated business bank account to keep bookkeeping clean and accurate.

Just as important is the security perspective. Regularly sending someone to the bank with cash exposes employees to real risk, and it creates a predictable pattern that can be exploited. The ABA Banking Journal has noted that too many cash-handling touch points, including trips to the bank, increase risk and can put employees in physical danger. Brink’s similarly points out that employees are exposed to theft risk when transporting cash, and that partnering with trained cash logistics professionals can reduce the risk of theft and increase accountability through secure transport procedures.

Some businesses try to replace bank runs with a courier pickup, but not every courier model is designed for cash. Cash transportation is high-risk, and the best solution is typically a purpose-built cash logistics provider whose job is secure cash handling, documentation, and transport. Trained cash logistics professionals and armored services are structured to reduce theft exposure and strengthen chain-of-custody and accountability, which is fundamentally different from general delivery services.

Surety Bank’s Smart Safe is designed specifically for cash-heavy businesses that want stronger security and a cleaner, more reliable deposit process. Surety explains that, through its partnership with Loomis, Smart Safe lets your business deposit cash on-site, receive provisional credit to your Surety Bank account, and eliminate unnecessary bank runs. From a security standpoint, Surety highlights benefits like real-time tracking of deposits, enhanced security for cash and employees, and better accountability with fewer cash shortages.

From a cash-flow standpoint, Surety’s process is built around speed. You enter the amount, deposit the cash into the Smart Safe device, and Surety provides provisional credit to your business account based on that entry. Loomis also describes provisional credit as daily credit for cash deposits without having to go to the bank, reducing time and helping reduce the risk of robbery outside the store.

If your business handles cash, the goal is to reduce handling, reduce trips, and reduce uncertainty. A strong plan usually includes keeping all business cash activity in business accounts and processes with clear documentation and daily reconciliation, minimizing manual bank runs, and using a Smart Safe with a professional cash logistics partner so deposits are tracked and transport is handled by specialists.

Contact our Treasury Services department today to learn how Smart Safe can help you strengthen security, simplify deposits, and improve visibility into your cash.

Adding a new product or service can significantly increase revenue for an MSB. Whether it is money transmission, ATM services, or another offering, early coordination with the bank helps ensure your new service launches smoothly and begins generating income as quickly as possible.

Many service-related delays occur when new offerings are added without notifying the bank in advance.

Each product or service comes with specific monitoring, reporting, and account requirements. The bank must be able to review activity accurately and ensure it aligns with regulatory expectations.

When a new service is launched without notice, activity may flow into the wrong account or lack required reporting. Fixing these issues after the service is live often causes delays or temporary interruptions.

ATM Services

If you are adding an ATM, the bank typically requires:

ATM activity cannot be combined with other MSB transactions due to reconciliation and compliance requirements.

Money Transmission Services

This includes services such as Western Union or other money transfer providers.

While these services may not require a separate account, they do require monthly reporting. At a minimum, reports must include:

These reports allow the bank to identify patterns, monitor risk, and meet regulatory obligations.

Even if a third-party provider has its own compliance program, the bank is still responsible for monitoring the activity flowing through your accounts.

Some MSBs assume that because a vendor manages compliance on their side, the bank does not need reporting. This is a common misconception. Ultimately, the funds flow through the bank, and the bank must conduct its own review.

Failing to provide required reporting can delay approvals, reviews, and future expansion plans.

Adding services often requires:

When these steps are completed in advance, services can go live quickly. When handled after launch, they often result in delays, holds, or additional review.

Growth is a positive step for any MSB. Whether you are adding a new product, service, or location, early communication with the bank helps ensure the process is efficient and compliant.

Starting the conversation early allows the bank to guide you, prepare properly, and help you move forward with fewer obstacles and less frustration.

If expansion is even a possibility, reaching out now can save significant time later.

Opening a new location is an exciting milestone for any MSB. New storefronts mean new customers, increased volume, and business growth. However, opening a new branch also brings additional banking, compliance, and operational requirements that must be completed before you can begin operating.

One of the most common causes of delayed openings is a lack of early or consistent communication with the bank. When the bank is informed early and kept in the loop, the process moves faster and far more smoothly.

From the bank’s perspective, opening a new MSB location is not simply adding another address. There are multiple regulatory, licensing, and operational steps that must be completed before the first transaction can take place.

We often see situations where a customer notifies the bank months in advance, receives a checklist of required items, then communication stops. When the customer reconnects and is ready to open, none of the required steps have been completed. At that point, the bank cannot approve activity, even if the storefront is ready.

Consistent communication ensures both sides stay aligned and prevents last-minute delays.

Depending on the state, services offered, and geographic location, opening a new branch may require:

Even experienced MSBs are sometimes surprised to learn that requirements vary by state and location. A location that works in one market may require different preparation in another.

Many MSBs assume that once a lease is signed and the store is ready, operations can begin immediately. From a banking and regulatory standpoint, this is not always the case.

If required licenses, amendments, or system testing are not completed, the bank cannot allow the location to operate. This is not meant to slow down your business. It is meant to protect both your operation and the bank from compliance violations.

The most efficient openings share a few things in common:

When communication stays consistent, opening timelines are shorter, approvals are smoother, and unexpected delays are far less likely.

When it comes to Money Service Businesses (MSBs), so much of the relationship between the bank and the customer happens behind the scenes through emails, phone calls, documents, and reviews. But sometimes, the most valuable conversations happen face to face.

Recently, Surety Bank conducted a series of on-site visits with MSB customers across Florida. In just two days, our team visited 12 businesses meeting owners where they operate, seeing workflows in real time, and having honest, productive conversations about compliance, fraud prevention, and growth.

The takeaway was clear: on-site visits create clarity, trust, and better outcomes for everyone involved.

From the bank’s side, we review transactions, reports, and data. But that only tells part of the story. Visiting MSBs in person allows us to see how your business actually operates, how customers flow through your store, how decisions are made, and what challenges you face day to day.

For many MSBs, this was the first time they were able to put a face to a name they usually only see in emails or hear on the phone. That alone made a difference. Customers were able to ask questions, share concerns, and better understand why certain compliance requirements exist, not just that they exist.

Site visits also help uncover small issues that can cause big delays later.

During one visit, a customer believed their corporate files were fully up to date. A quick spot check showed otherwise: expired corporate resolutions, missing documentation, and records that hadn’t been refreshed annually as required by Surety Bank policy.

That conversation mattered. Without those documents:

● Checks could be delayed or placed on hold

● Approvals could be paused

● Cash flow could be impacted

Addressing these gaps during a site visit helps MSBs avoid last-minute scrambles, rejected transactions, and unnecessary frustration.

Another consistent theme during site visits was fraud. MSBs are very aware that they are vulnerable and site visits give us the opportunity to talk through practical, preventative steps.

From understanding why certain customers are blocked, to recognizing patterns of suspicious activity, these conversations help MSBs make better decisions before a check is cashed rather than dealing with losses afterward.

Based on the success of these visits, Surety Bank will be conducting more on-site visits starting in the new year. While we can’t visit every MSB at once, we are prioritizing visits based on risk assessments and geographic proximity.

These visits are not audits. They are not meant to tell you how to run your business.

They are meant to:

● Build stronger relationships

● Provide clarity around compliance expectations

● Identify issues early

● Support MSBs with real, practical guidance

Most importantly, they reinforce one thing: we’re here, we’re accessible, and we care about your success.

If you would like to request a site visit or learn more about what to expect, we encourage you to reach out and our team will follow up to discuss next steps.

Email: msb@surety.bank

At Surety Bank, we believe strong partnerships are built through communication, transparency, and mutual understanding. On-site visits help bridge the gap between policy and practice and we look forward to continuing these conversations in person throughout the year ahead.

For many Money Service Businesses (MSBs), a point-of-sale (POS) check-cashing system is required in order to bank with Surety. Larger MSBs generally use these systems as intended but smaller, “mom-and-pop” MSBs often don’t fully understand the capabilities of the software they’re paying for each month.

This gap has created significant issues for MSBs and for our analysts when performing compliance reviews.

The truth is: your POS system is not just a transaction tool. It is a powerful compliance engine. And when it’s used correctly, it protects both your business and the bank.

Every approved vendor on Surety’s list provides a robust set of compliance features. These tools are designed to:

But when MSBs don’t know how to operate the system, or bypass required fields, these features fail, and risk increases.

The transcription captures several recurring issues we see during reviews. Below are the biggest problems and how to fix them.

MSBs must take a clear photo of each customer.

But many stores:

This becomes a problem when analysts need to match customers to suspicious activity.

Fix:

✔ Adjust the camera.

✔ Make sure the customer is actually looking at the lens.

✔ Retake the photo if it's unclear.

When an ID is scanned, the system autofills the address.

But 8 out of 10 profiles contain outdated, inaccurate addresses. This causes major compliance issues when filing CTRs or SARs.

Fix:

✔ Always verbally confirm the customer’s current address.

✔ Update the POS record manually when the ID address is outdated.

Some MSBs never used OFAC checks until Surety required POS systems.

Now they have access to the tool and still forget to use it.

Fix:

✔ Ensure OFAC checks run on every customer, every time.

This is one of the biggest issues.Many MSBs edit the payee section and mistakenly enter:

❌ The name of the person cashing the check (the conductor) instead of:

✔ The name of the entity the check is actually payable to.

This leads to:

Fix:

✔ Always enter the maker and payee correctly. ✔ Never leave fields blank. ✔ Never rely on whatever the system “guesses.”

Your POS system is capable of detecting fraudulent checks before you cash them. But some MSBs override alerts manually, sometimes losing thousands of dollars.

Fix:

✔ Trust the system.

✔ Never override a fraud alert.

✔ Stop the transaction and ask questions.

Most POS vendors offer:

MSBs are strongly encouraged to schedule additional training with their vendor to learn the system fully.

When MSBs use the POS system properly:

If the system is used upfront, risk drops dramatically and compliance becomes smoother for everyone.

Your POS system can only help you if you use it. By taking advantage of the features you’re already paying for, you’ll reduce risk, increase accuracy, and build a stronger compliance foundation for your business.

For cash-heavy businesses, deposit routines are not just an operations detail. They are a security issue, a controls issue, and often a cash-flow issue. When business cash gets deposited “personally,” meaning an owner or employee deposits cash through personal banking habits or into the wrong account, it can blur your recordkeeping and weaken internal controls. The IRS notes it is a good idea to keep separate business and personal accounts because it makes recordkeeping easier. The U.S. Small Business Administration also emphasizes separating funds by using a dedicated business bank account to keep bookkeeping clean and accurate.

Just as important is the security perspective. Regularly sending someone to the bank with cash exposes employees to real risk, and it creates a predictable pattern that can be exploited. The ABA Banking Journal has noted that too many cash-handling touch points, including trips to the bank, increase risk and can put employees in physical danger. Brink’s similarly points out that employees are exposed to theft risk when transporting cash, and that partnering with trained cash logistics professionals can reduce the risk of theft and increase accountability through secure transport procedures.

Some businesses try to replace bank runs with a courier pickup, but not every courier model is designed for cash. Cash transportation is high-risk, and the best solution is typically a purpose-built cash logistics provider whose job is secure cash handling, documentation, and transport. Trained cash logistics professionals and armored services are structured to reduce theft exposure and strengthen chain-of-custody and accountability, which is fundamentally different from general delivery services.

Surety Bank’s Smart Safe is designed specifically for cash-heavy businesses that want stronger security and a cleaner, more reliable deposit process. Surety explains that, through its partnership with Loomis, Smart Safe lets your business deposit cash on-site, receive provisional credit to your Surety Bank account, and eliminate unnecessary bank runs. From a security standpoint, Surety highlights benefits like real-time tracking of deposits, enhanced security for cash and employees, and better accountability with fewer cash shortages.

From a cash-flow standpoint, Surety’s process is built around speed. You enter the amount, deposit the cash into the Smart Safe device, and Surety provides provisional credit to your business account based on that entry. Loomis also describes provisional credit as daily credit for cash deposits without having to go to the bank, reducing time and helping reduce the risk of robbery outside the store.

If your business handles cash, the goal is to reduce handling, reduce trips, and reduce uncertainty. A strong plan usually includes keeping all business cash activity in business accounts and processes with clear documentation and daily reconciliation, minimizing manual bank runs, and using a Smart Safe with a professional cash logistics partner so deposits are tracked and transport is handled by specialists.

Contact our Treasury Services department today to learn how Smart Safe can help you strengthen security, simplify deposits, and improve visibility into your cash.

At first glance, a checking account is a checking account. Money comes in, money goes out, and you check the balance when you need to. But the day you start running a business, the rules change, because the risk changes. Business accounts aren’t just “bigger” consumer accounts. They typically handle more transactions, more users, more payment types, and more moving parts.

There’s another key difference many owners don’t realize until it’s too late: business accounts generally do not have the same level of consumer protections that consumer (personal) accounts do. When something goes wrong, the process, timelines, and potential liability can look very different. That’s why fraud prevention for businesses isn’t optional. It’s operational.

Consumer (personal) accounts are usually simpler:

Business accounts are different by design:

And because business accounts are treated differently than consumer accounts, the responsibility to monitor activity and catch issues early often rests more heavily on the business.

Most business owners are busy. Delegating bookkeeping is smart, because your time is valuable. But delegation without visibility is where risk grows, especially when one person has end-to-end control.

Internal fraud often looks like:

It’s rarely dramatic at the beginning. It’s usually quiet, incremental, and designed not to be noticed.

Consider Lisa, who owns a growing medical practice. She hired a bookkeeper to “handle the finances” and assumed monthly reports were enough. Lisa rarely reviewed actual transactions unless something felt off.

Over time, the bookkeeper began issuing checks to a vendor that sounded legitimate. The amounts were small—$180 here, $250 there—coded as routine office supplies. The practice was busy, revenue was strong, and nothing looked “wrong” at a high level.

Six months later, Lisa’s accountant flagged unusual expense patterns during a quarterly review. By then, the total loss wasn’t a rounding error. It was meaningful, and the cleanup took time, created stress, and required uncomfortable conversations. The hardest part wasn’t just the money; it was realizing the problem could have been caught early with simple, consistent oversight.

You don’t need to become your own bookkeeper. You just need a rhythm of review that helps you spot unusual activity quickly, especially because business accounts don’t always come with the same consumer-style protections.

Try these straightforward habits:

Strong habits matter, but systems are what help you scale safely. Depending on your business, ask about tools such as:

Surety Bank can help you evaluate which controls fit your operation, set permissions correctly, and implement tools like Positive Pay in a way that’s practical—not burdensome. The goal is to put guardrails in place that make fraud harder to commit and easier to catch, without slowing down your business.

Residential accounts are often simpler and tend to come with broader consumer-style protections. Business accounts operate differently—more volume, more access, more complexity, and often less built-in protection. That’s why vigilance isn’t just a best practice; it’s part of responsible business ownership.

Fraud prevention isn’t about paranoia. It’s about professionalism: review regularly, limit access wisely, and build systems that protect your business long before problems appear.

Adding a new product or service can significantly increase revenue for an MSB. Whether it is money transmission, ATM services, or another offering, early coordination with the bank helps ensure your new service launches smoothly and begins generating income as quickly as possible.

Many service-related delays occur when new offerings are added without notifying the bank in advance.

Each product or service comes with specific monitoring, reporting, and account requirements. The bank must be able to review activity accurately and ensure it aligns with regulatory expectations.

When a new service is launched without notice, activity may flow into the wrong account or lack required reporting. Fixing these issues after the service is live often causes delays or temporary interruptions.

ATM Services

If you are adding an ATM, the bank typically requires:

ATM activity cannot be combined with other MSB transactions due to reconciliation and compliance requirements.

Money Transmission Services

This includes services such as Western Union or other money transfer providers.

While these services may not require a separate account, they do require monthly reporting. At a minimum, reports must include:

These reports allow the bank to identify patterns, monitor risk, and meet regulatory obligations.

Even if a third-party provider has its own compliance program, the bank is still responsible for monitoring the activity flowing through your accounts.

Some MSBs assume that because a vendor manages compliance on their side, the bank does not need reporting. This is a common misconception. Ultimately, the funds flow through the bank, and the bank must conduct its own review.

Failing to provide required reporting can delay approvals, reviews, and future expansion plans.

Adding services often requires:

When these steps are completed in advance, services can go live quickly. When handled after launch, they often result in delays, holds, or additional review.

Growth is a positive step for any MSB. Whether you are adding a new product, service, or location, early communication with the bank helps ensure the process is efficient and compliant.

Starting the conversation early allows the bank to guide you, prepare properly, and help you move forward with fewer obstacles and less frustration.

If expansion is even a possibility, reaching out now can save significant time later.

Opening a new location is an exciting milestone for any MSB. New storefronts mean new customers, increased volume, and business growth. However, opening a new branch also brings additional banking, compliance, and operational requirements that must be completed before you can begin operating.

One of the most common causes of delayed openings is a lack of early or consistent communication with the bank. When the bank is informed early and kept in the loop, the process moves faster and far more smoothly.

From the bank’s perspective, opening a new MSB location is not simply adding another address. There are multiple regulatory, licensing, and operational steps that must be completed before the first transaction can take place.

We often see situations where a customer notifies the bank months in advance, receives a checklist of required items, then communication stops. When the customer reconnects and is ready to open, none of the required steps have been completed. At that point, the bank cannot approve activity, even if the storefront is ready.

Consistent communication ensures both sides stay aligned and prevents last-minute delays.

Depending on the state, services offered, and geographic location, opening a new branch may require:

Even experienced MSBs are sometimes surprised to learn that requirements vary by state and location. A location that works in one market may require different preparation in another.

Many MSBs assume that once a lease is signed and the store is ready, operations can begin immediately. From a banking and regulatory standpoint, this is not always the case.

If required licenses, amendments, or system testing are not completed, the bank cannot allow the location to operate. This is not meant to slow down your business. It is meant to protect both your operation and the bank from compliance violations.

The most efficient openings share a few things in common:

When communication stays consistent, opening timelines are shorter, approvals are smoother, and unexpected delays are far less likely.

When it comes to Money Service Businesses (MSBs), so much of the relationship between the bank and the customer happens behind the scenes through emails, phone calls, documents, and reviews. But sometimes, the most valuable conversations happen face to face.

Recently, Surety Bank conducted a series of on-site visits with MSB customers across Florida. In just two days, our team visited 12 businesses meeting owners where they operate, seeing workflows in real time, and having honest, productive conversations about compliance, fraud prevention, and growth.

The takeaway was clear: on-site visits create clarity, trust, and better outcomes for everyone involved.

From the bank’s side, we review transactions, reports, and data. But that only tells part of the story. Visiting MSBs in person allows us to see how your business actually operates, how customers flow through your store, how decisions are made, and what challenges you face day to day.

For many MSBs, this was the first time they were able to put a face to a name they usually only see in emails or hear on the phone. That alone made a difference. Customers were able to ask questions, share concerns, and better understand why certain compliance requirements exist, not just that they exist.

Site visits also help uncover small issues that can cause big delays later.

During one visit, a customer believed their corporate files were fully up to date. A quick spot check showed otherwise: expired corporate resolutions, missing documentation, and records that hadn’t been refreshed annually as required by Surety Bank policy.

That conversation mattered. Without those documents:

● Checks could be delayed or placed on hold

● Approvals could be paused

● Cash flow could be impacted

Addressing these gaps during a site visit helps MSBs avoid last-minute scrambles, rejected transactions, and unnecessary frustration.

Another consistent theme during site visits was fraud. MSBs are very aware that they are vulnerable and site visits give us the opportunity to talk through practical, preventative steps.

From understanding why certain customers are blocked, to recognizing patterns of suspicious activity, these conversations help MSBs make better decisions before a check is cashed rather than dealing with losses afterward.

Based on the success of these visits, Surety Bank will be conducting more on-site visits starting in the new year. While we can’t visit every MSB at once, we are prioritizing visits based on risk assessments and geographic proximity.

These visits are not audits. They are not meant to tell you how to run your business.

They are meant to:

● Build stronger relationships

● Provide clarity around compliance expectations

● Identify issues early

● Support MSBs with real, practical guidance

Most importantly, they reinforce one thing: we’re here, we’re accessible, and we care about your success.

If you would like to request a site visit or learn more about what to expect, we encourage you to reach out and our team will follow up to discuss next steps.

Email: msb@surety.bank

At Surety Bank, we believe strong partnerships are built through communication, transparency, and mutual understanding. On-site visits help bridge the gap between policy and practice and we look forward to continuing these conversations in person throughout the year ahead.

For many Money Service Businesses (MSBs), a point-of-sale (POS) check-cashing system is required in order to bank with Surety. Larger MSBs generally use these systems as intended but smaller, “mom-and-pop” MSBs often don’t fully understand the capabilities of the software they’re paying for each month.

This gap has created significant issues for MSBs and for our analysts when performing compliance reviews.

The truth is: your POS system is not just a transaction tool. It is a powerful compliance engine. And when it’s used correctly, it protects both your business and the bank.

Every approved vendor on Surety’s list provides a robust set of compliance features. These tools are designed to:

But when MSBs don’t know how to operate the system, or bypass required fields, these features fail, and risk increases.

The transcription captures several recurring issues we see during reviews. Below are the biggest problems and how to fix them.

MSBs must take a clear photo of each customer.

But many stores:

This becomes a problem when analysts need to match customers to suspicious activity.

Fix:

✔ Adjust the camera.

✔ Make sure the customer is actually looking at the lens.

✔ Retake the photo if it's unclear.

When an ID is scanned, the system autofills the address.

But 8 out of 10 profiles contain outdated, inaccurate addresses. This causes major compliance issues when filing CTRs or SARs.

Fix:

✔ Always verbally confirm the customer’s current address.

✔ Update the POS record manually when the ID address is outdated.

Some MSBs never used OFAC checks until Surety required POS systems.

Now they have access to the tool and still forget to use it.

Fix:

✔ Ensure OFAC checks run on every customer, every time.

This is one of the biggest issues.Many MSBs edit the payee section and mistakenly enter:

❌ The name of the person cashing the check (the conductor) instead of:

✔ The name of the entity the check is actually payable to.

This leads to:

Fix:

✔ Always enter the maker and payee correctly. ✔ Never leave fields blank. ✔ Never rely on whatever the system “guesses.”

Your POS system is capable of detecting fraudulent checks before you cash them. But some MSBs override alerts manually, sometimes losing thousands of dollars.

Fix:

✔ Trust the system.

✔ Never override a fraud alert.

✔ Stop the transaction and ask questions.

Most POS vendors offer:

MSBs are strongly encouraged to schedule additional training with their vendor to learn the system fully.

When MSBs use the POS system properly:

If the system is used upfront, risk drops dramatically and compliance becomes smoother for everyone.

Your POS system can only help you if you use it. By taking advantage of the features you’re already paying for, you’ll reduce risk, increase accuracy, and build a stronger compliance foundation for your business.

It’s November, your store is packed, the line at the register is snaking down the aisle and your seasonal staff is doing their best to keep up. You’re watching every sale, every return and every refund, knowing that the next six weeks can make or break your year. With card processing fees climbing, it’s tempting to push customers toward cash and even add a 3% “convenience” or “non-cash adjustment” fee when they tap or swipe a card. After all, there are no fees on cash… right?

The problem is that cash comes with its own price tag, one most retailers don’t see until it’s quietly eaten into their margins.

A study by the Small Business & Entrepreneurship Council found that the real cost of cash can range from 4.7% (grocery) to as high as 15.5% (bars and restaurants) once you factor in labor, handling and shrinkage. That means for every $100 in cash you accept, you might really be keeping only $84.50 to $95.30.

For many retailers, the biggest hidden cost is time:

For example, convenience stores—which operate in a similar high-volume, low-margin environment as many retailers—spend an estimated 15–20 hours per week just counting and handling cash. At an average wage of $14.33 per hour, that’s:

Over a year, that works out to $11,177–$14,903 in labor just to handle cash. During the holidays, when lines are longer and staff is stretched thinner, those hours often go up, not down.

Cash also keeps you in the dark longer than you might realize. With cash-heavy operations, you often don’t know your true daily performance until drawers are counted, deposits are prepared and everything is reconciled—sometimes hours after the store closes. That lag makes it harder to adjust staffing, reorder inventory or tweak promotions while it still matters.

Electronic payments, by contrast, can feed real-time metrics into your point-of-sale and treasury platforms. You can see, often down to the hour, what’s selling, which locations are busiest, which promotions are working and how your cash flow looks heading into the next day. That visibility is especially valuable in the holiday rush, when a fast decision about staffing or inventory can mean the difference between a record weekend and missed opportunities.

On top of labor, cash exposes retailers to risks that electronic payments help reduce:

This is why many banks are rolling out treasury platforms with fraud controls, positive pay, ACH options and remote deposit capture to help business customers move away from “cash management” and toward cash flow management. Framing the conversation around speed, security, real-time information and time savings can be more effective—and more honest—than simply pushing for “more cash.”

Let’s apply real numbers to a typical retail scenario.

Say you own a store and decide to add a 3% convenience fee to card transactions while still accepting cash. Here’s what happens on a $100 ticket:

Card payment with a 3% convenience fee

Cash payment with hidden costs (using the 15.5% example)

So for every $100 transaction, you effectively keep:

That’s a $15.41 difference per $100 ticket in favor of electronic payments.

During the holidays, when your volume spikes, that gap adds up quickly. The season you’ve been counting on to boost profits can quietly turn into the season where hidden cash costs quietly steal them away, one transaction at a time.

If you’d like to talk through how to reduce the hidden costs of cash, improve fraud protection and gain better real-time visibility into your business accounts and merchant processing, contact Surety’s Treasury Services Department to discuss business accounts and merchant accounts with built-in protection.

This is a fictitious story—but it's based on real events that happen to small businesses every single day.

The owner of a thriving local furniture business had just signed the biggest deal of the year. Everything seemed on track until her bookkeeper received an email from a familiar client with “updated wire instructions.” The message looked legitimate. No red flags. So the payment—nearly $50,000—was sent. Two days later, the real client called to say the deposit never arrived. The money was gone. And so was the illusion that something like this “would never happen to us.”

Within a week, long-time customers started asking tough questions. A supplier tightened payment terms. A local partnership quietly backed out of an event. And worse—people started whispering that the business “might not be secure.”

This is how quickly a single fraud incident can unravel years of hard-earned trust.

Even if you recover the stolen funds or file an insurance claim, the damage to your reputation can last far longer—and cut deeper.

Protecting your business starts with building strong internal controls and using the tools your bank offers:

Surety Bank offers many of these solutions through our Treasury team, and we can help tailor them to your specific operations.

Even with great controls, no system is bulletproof. If fraud strikes, your response will determine how much damage your reputation takes—and how quickly you can recover.

In the first 72 hours:

In the weeks that follow:

This fictitious business was lucky—it survived. But the lesson is clear: fraud isn’t just a financial risk, it’s a reputational one. And once trust is broken, it takes time, strategy, and transparency to win it back.

At Surety Bank, we help businesses of all sizes protect their operations from fraud. Whether you need payment controls, alert systems, or a plan for what to do in a crisis, our Treasury & Fraud Prevention Team is here to help.

In the Summer 2025 issue of Building Central Florida Magazine, Surety Bank’s CEO Ryan James maps out a playbook for contractors battling the tariff-driven spikes in steel, aluminum, and other construction staples. James urges firms to replace one-job-at-a-time budgeting with rolling, company-wide cash-flow forecasts; to negotiate for delivery and payment flexibility; to lock in contingency capital before trouble hits; and to embed escalation clauses that keep margins intact—all while maintaining proactive, transparent communication with clients.

Read the full article on page 17:

Building Through the Turbulence – Building Central Florida Magazine

It’s easy to assume that in a digital world, check fraud is a thing of the past. But the reality is quite the opposite. In 2023 alone, check fraud losses in the Americas totaled a staggering $21 billion—representing 80% of all global check fraud cases. Despite a steady decline in the use of checks, fraudsters are doubling down on a still-vulnerable payment channel.

So what happens when a check your business issued ends up in the wrong hands?

Let’s say you wrote a vendor check back in February. Today, that check suddenly clears—but it’s been altered or stolen. What’s your next move? Do you catch it in time? Will your bank reimburse the loss? If you’re like many business owners, you’d expect your bank to take care of it. But depending on the terms in your bank’s Deposit Agreement, you may only have 30 days from the date of your statement to report the fraud and recover those funds. And once that window closes, so may your chances of getting that money back.

At Surety Bank, we want our business clients to know that help exists—and it's called Positive Pay.

Positive Pay is a fraud prevention tool that verifies checks presented for payment against a list of checks you’ve actually issued. If the details don’t match, the bank flags the check and reaches out before funds are released.

It’s like having a security checkpoint for every check your business issues.

Here’s what fraud can really cost your business:

Surety Bank’s Positive Pay solution is designed to reduce those risks before they become losses. Instead of waiting for fraud to strike, it gives business owners a chance to act first.

Most business owners don’t have the luxury of watching every check line item on their bank statement. Positive Pay works in the background—quietly checking, flagging, and helping you intercept fraud before it’s too late.

By offering this service, we’re not just protecting your account—we’re protecting your time, your reputation, and your peace of mind.

Check fraud isn’t going away. But your exposure to it can.

If you’re still issuing paper checks, it’s time to ask yourself: How am I protecting my business from check fraud? At Surety Bank, we’re ready to help you find the answer.

Reach out to our Treasury Management team to learn how Positive Pay can fit into your fraud prevention strategy.

Paper checks may feel old-school, yet they remain the easiest gateway for thieves. The U.S. Treasury reports that check-fraud suspicious-activity filings have climbed 385 percent since the pandemic, while 63 percent of companies faced attempted or actual check fraud in 2024, according to the Association for Financial Professionals’ 2025 survey.occ.govafponline.org Those numbers tell a blunt story: even as businesses adopt ACH and virtual cards, the humble check still opens a back door to five- and six-figure losses.

The phone lit up in the back office of Sunshine Custom Cabinets on a Thursday afternoon.

Co-owner Angela Moreno glanced at the caller ID from her bank and expected a routine wire inquiry. Instead she heard:

“Ms. Moreno, six checks just cleared your account for almost ten thousand dollars each. Can you confirm them?”

Angela had mailed only three checks that week, none over $4,500. Somewhere between the post-office drop box and her suppliers’ lockboxes, thieves had “washed” the envelopes, bleached the ink, and rewritten the checks for a cool $59,821.32—wiping out two payroll cycles in minutes.

The next 48 hours blurred into police reports, fraud affidavits, and tense conversations with employees wondering if Friday’s pay would arrive. The bank eventually credited most of the money, but cash flow froze for nearly a month, and the team sank forty billable hours into cleaning up—a cost no insurance policy reimbursed.

Check fraud has morphed from fax-era nuisance to organized, AI-enhanced side hustle. The good news: consistent, unglamorous discipline—secure mailing, rapid reconciliation, and an automated pre-clearance layer—sends fraudsters looking for softer targets. Angela calls that Thursday “the most expensive lesson I never budgeted for.” Tighten your routine today, and you won’t need the same wake-up call.

Need a practical walkthrough of daily controls—minus the jargon? Talk with our Treasury Management team about fitting these layers to your workflow before your next envelope hits the mail.

As more banking moves online, security has become just as important as convenience. Whether you’re checking a personal account or managing company finances, your computer habits play a critical role in keeping your information safe. A few consistent practices can greatly reduce your risk of fraud and protect sensitive data.

Malware can capture keystrokes, steal login credentials, and access personal files without you realizing it. To stay protected:

Make full use of the security tools your devices and bank provide:

Closing your browser window isn’t enough to end your session.

Browsers can store sensitive information like login pages or cached credentials. To protect yourself:

Phishing emails and fraudulent pop-ups can trick you into giving away banking information. Watch for:

Best practice: Always access your bank by typing the official web address directly into your browser, never through email or ad links.

Businesses face higher risks, so proactive steps are essential:

Online banking can be safe and reliable when paired with good cybersecurity habits. By:

…you can protect both your finances and your peace of mind.

The key is consistency. Security isn’t a one-time task—it’s a set of habits built into your everyday banking routine. Taking these steps ensures your accounts remain secure, your sensitive information stays private, and you can manage your finances confidently, whether personally or for your business.

At first glance, a checking account is a checking account. Money comes in, money goes out, and you check the balance when you need to. But the day you start running a business, the rules change, because the risk changes. Business accounts aren’t just “bigger” consumer accounts. They typically handle more transactions, more users, more payment types, and more moving parts.

There’s another key difference many owners don’t realize until it’s too late: business accounts generally do not have the same level of consumer protections that consumer (personal) accounts do. When something goes wrong, the process, timelines, and potential liability can look very different. That’s why fraud prevention for businesses isn’t optional. It’s operational.

Consumer (personal) accounts are usually simpler:

Business accounts are different by design:

And because business accounts are treated differently than consumer accounts, the responsibility to monitor activity and catch issues early often rests more heavily on the business.

Most business owners are busy. Delegating bookkeeping is smart, because your time is valuable. But delegation without visibility is where risk grows, especially when one person has end-to-end control.

Internal fraud often looks like:

It’s rarely dramatic at the beginning. It’s usually quiet, incremental, and designed not to be noticed.

Consider Lisa, who owns a growing medical practice. She hired a bookkeeper to “handle the finances” and assumed monthly reports were enough. Lisa rarely reviewed actual transactions unless something felt off.

Over time, the bookkeeper began issuing checks to a vendor that sounded legitimate. The amounts were small—$180 here, $250 there—coded as routine office supplies. The practice was busy, revenue was strong, and nothing looked “wrong” at a high level.

Six months later, Lisa’s accountant flagged unusual expense patterns during a quarterly review. By then, the total loss wasn’t a rounding error. It was meaningful, and the cleanup took time, created stress, and required uncomfortable conversations. The hardest part wasn’t just the money; it was realizing the problem could have been caught early with simple, consistent oversight.

You don’t need to become your own bookkeeper. You just need a rhythm of review that helps you spot unusual activity quickly, especially because business accounts don’t always come with the same consumer-style protections.

Try these straightforward habits:

Strong habits matter, but systems are what help you scale safely. Depending on your business, ask about tools such as:

Surety Bank can help you evaluate which controls fit your operation, set permissions correctly, and implement tools like Positive Pay in a way that’s practical—not burdensome. The goal is to put guardrails in place that make fraud harder to commit and easier to catch, without slowing down your business.

Residential accounts are often simpler and tend to come with broader consumer-style protections. Business accounts operate differently—more volume, more access, more complexity, and often less built-in protection. That’s why vigilance isn’t just a best practice; it’s part of responsible business ownership.

Fraud prevention isn’t about paranoia. It’s about professionalism: review regularly, limit access wisely, and build systems that protect your business long before problems appear.

For cash-heavy businesses, deposit routines are not just an operations detail. They are a security issue, a controls issue, and often a cash-flow issue. When business cash gets deposited “personally,” meaning an owner or employee deposits cash through personal banking habits or into the wrong account, it can blur your recordkeeping and weaken internal controls. The IRS notes it is a good idea to keep separate business and personal accounts because it makes recordkeeping easier. The U.S. Small Business Administration also emphasizes separating funds by using a dedicated business bank account to keep bookkeeping clean and accurate.

Just as important is the security perspective. Regularly sending someone to the bank with cash exposes employees to real risk, and it creates a predictable pattern that can be exploited. The ABA Banking Journal has noted that too many cash-handling touch points, including trips to the bank, increase risk and can put employees in physical danger. Brink’s similarly points out that employees are exposed to theft risk when transporting cash, and that partnering with trained cash logistics professionals can reduce the risk of theft and increase accountability through secure transport procedures.

Some businesses try to replace bank runs with a courier pickup, but not every courier model is designed for cash. Cash transportation is high-risk, and the best solution is typically a purpose-built cash logistics provider whose job is secure cash handling, documentation, and transport. Trained cash logistics professionals and armored services are structured to reduce theft exposure and strengthen chain-of-custody and accountability, which is fundamentally different from general delivery services.

Surety Bank’s Smart Safe is designed specifically for cash-heavy businesses that want stronger security and a cleaner, more reliable deposit process. Surety explains that, through its partnership with Loomis, Smart Safe lets your business deposit cash on-site, receive provisional credit to your Surety Bank account, and eliminate unnecessary bank runs. From a security standpoint, Surety highlights benefits like real-time tracking of deposits, enhanced security for cash and employees, and better accountability with fewer cash shortages.

From a cash-flow standpoint, Surety’s process is built around speed. You enter the amount, deposit the cash into the Smart Safe device, and Surety provides provisional credit to your business account based on that entry. Loomis also describes provisional credit as daily credit for cash deposits without having to go to the bank, reducing time and helping reduce the risk of robbery outside the store.

If your business handles cash, the goal is to reduce handling, reduce trips, and reduce uncertainty. A strong plan usually includes keeping all business cash activity in business accounts and processes with clear documentation and daily reconciliation, minimizing manual bank runs, and using a Smart Safe with a professional cash logistics partner so deposits are tracked and transport is handled by specialists.

Contact our Treasury Services department today to learn how Smart Safe can help you strengthen security, simplify deposits, and improve visibility into your cash.

Adding a new product or service can significantly increase revenue for an MSB. Whether it is money transmission, ATM services, or another offering, early coordination with the bank helps ensure your new service launches smoothly and begins generating income as quickly as possible.

Many service-related delays occur when new offerings are added without notifying the bank in advance.

Each product or service comes with specific monitoring, reporting, and account requirements. The bank must be able to review activity accurately and ensure it aligns with regulatory expectations.

When a new service is launched without notice, activity may flow into the wrong account or lack required reporting. Fixing these issues after the service is live often causes delays or temporary interruptions.

ATM Services

If you are adding an ATM, the bank typically requires:

ATM activity cannot be combined with other MSB transactions due to reconciliation and compliance requirements.

Money Transmission Services

This includes services such as Western Union or other money transfer providers.

While these services may not require a separate account, they do require monthly reporting. At a minimum, reports must include:

These reports allow the bank to identify patterns, monitor risk, and meet regulatory obligations.

Even if a third-party provider has its own compliance program, the bank is still responsible for monitoring the activity flowing through your accounts.

Some MSBs assume that because a vendor manages compliance on their side, the bank does not need reporting. This is a common misconception. Ultimately, the funds flow through the bank, and the bank must conduct its own review.

Failing to provide required reporting can delay approvals, reviews, and future expansion plans.

Adding services often requires:

When these steps are completed in advance, services can go live quickly. When handled after launch, they often result in delays, holds, or additional review.

Growth is a positive step for any MSB. Whether you are adding a new product, service, or location, early communication with the bank helps ensure the process is efficient and compliant.

Starting the conversation early allows the bank to guide you, prepare properly, and help you move forward with fewer obstacles and less frustration.

If expansion is even a possibility, reaching out now can save significant time later.

Opening a new location is an exciting milestone for any MSB. New storefronts mean new customers, increased volume, and business growth. However, opening a new branch also brings additional banking, compliance, and operational requirements that must be completed before you can begin operating.

One of the most common causes of delayed openings is a lack of early or consistent communication with the bank. When the bank is informed early and kept in the loop, the process moves faster and far more smoothly.

From the bank’s perspective, opening a new MSB location is not simply adding another address. There are multiple regulatory, licensing, and operational steps that must be completed before the first transaction can take place.

We often see situations where a customer notifies the bank months in advance, receives a checklist of required items, then communication stops. When the customer reconnects and is ready to open, none of the required steps have been completed. At that point, the bank cannot approve activity, even if the storefront is ready.

Consistent communication ensures both sides stay aligned and prevents last-minute delays.

Depending on the state, services offered, and geographic location, opening a new branch may require:

Even experienced MSBs are sometimes surprised to learn that requirements vary by state and location. A location that works in one market may require different preparation in another.

Many MSBs assume that once a lease is signed and the store is ready, operations can begin immediately. From a banking and regulatory standpoint, this is not always the case.

If required licenses, amendments, or system testing are not completed, the bank cannot allow the location to operate. This is not meant to slow down your business. It is meant to protect both your operation and the bank from compliance violations.

The most efficient openings share a few things in common:

When communication stays consistent, opening timelines are shorter, approvals are smoother, and unexpected delays are far less likely.

When it comes to Money Service Businesses (MSBs), so much of the relationship between the bank and the customer happens behind the scenes through emails, phone calls, documents, and reviews. But sometimes, the most valuable conversations happen face to face.

Recently, Surety Bank conducted a series of on-site visits with MSB customers across Florida. In just two days, our team visited 12 businesses meeting owners where they operate, seeing workflows in real time, and having honest, productive conversations about compliance, fraud prevention, and growth.

The takeaway was clear: on-site visits create clarity, trust, and better outcomes for everyone involved.

From the bank’s side, we review transactions, reports, and data. But that only tells part of the story. Visiting MSBs in person allows us to see how your business actually operates, how customers flow through your store, how decisions are made, and what challenges you face day to day.

For many MSBs, this was the first time they were able to put a face to a name they usually only see in emails or hear on the phone. That alone made a difference. Customers were able to ask questions, share concerns, and better understand why certain compliance requirements exist, not just that they exist.

Site visits also help uncover small issues that can cause big delays later.

During one visit, a customer believed their corporate files were fully up to date. A quick spot check showed otherwise: expired corporate resolutions, missing documentation, and records that hadn’t been refreshed annually as required by Surety Bank policy.

That conversation mattered. Without those documents:

● Checks could be delayed or placed on hold

● Approvals could be paused

● Cash flow could be impacted

Addressing these gaps during a site visit helps MSBs avoid last-minute scrambles, rejected transactions, and unnecessary frustration.

Another consistent theme during site visits was fraud. MSBs are very aware that they are vulnerable and site visits give us the opportunity to talk through practical, preventative steps.

From understanding why certain customers are blocked, to recognizing patterns of suspicious activity, these conversations help MSBs make better decisions before a check is cashed rather than dealing with losses afterward.

Based on the success of these visits, Surety Bank will be conducting more on-site visits starting in the new year. While we can’t visit every MSB at once, we are prioritizing visits based on risk assessments and geographic proximity.

These visits are not audits. They are not meant to tell you how to run your business.

They are meant to:

● Build stronger relationships

● Provide clarity around compliance expectations

● Identify issues early

● Support MSBs with real, practical guidance

Most importantly, they reinforce one thing: we’re here, we’re accessible, and we care about your success.

If you would like to request a site visit or learn more about what to expect, we encourage you to reach out and our team will follow up to discuss next steps.

Email: msb@surety.bank

At Surety Bank, we believe strong partnerships are built through communication, transparency, and mutual understanding. On-site visits help bridge the gap between policy and practice and we look forward to continuing these conversations in person throughout the year ahead.

For many Money Service Businesses (MSBs), a point-of-sale (POS) check-cashing system is required in order to bank with Surety. Larger MSBs generally use these systems as intended but smaller, “mom-and-pop” MSBs often don’t fully understand the capabilities of the software they’re paying for each month.

This gap has created significant issues for MSBs and for our analysts when performing compliance reviews.

The truth is: your POS system is not just a transaction tool. It is a powerful compliance engine. And when it’s used correctly, it protects both your business and the bank.

Every approved vendor on Surety’s list provides a robust set of compliance features. These tools are designed to:

But when MSBs don’t know how to operate the system, or bypass required fields, these features fail, and risk increases.

The transcription captures several recurring issues we see during reviews. Below are the biggest problems and how to fix them.

MSBs must take a clear photo of each customer.

But many stores:

This becomes a problem when analysts need to match customers to suspicious activity.

Fix:

✔ Adjust the camera.

✔ Make sure the customer is actually looking at the lens.

✔ Retake the photo if it's unclear.

When an ID is scanned, the system autofills the address.

But 8 out of 10 profiles contain outdated, inaccurate addresses. This causes major compliance issues when filing CTRs or SARs.

Fix:

✔ Always verbally confirm the customer’s current address.

✔ Update the POS record manually when the ID address is outdated.

Some MSBs never used OFAC checks until Surety required POS systems.

Now they have access to the tool and still forget to use it.

Fix:

✔ Ensure OFAC checks run on every customer, every time.

This is one of the biggest issues.Many MSBs edit the payee section and mistakenly enter:

❌ The name of the person cashing the check (the conductor) instead of:

✔ The name of the entity the check is actually payable to.

This leads to:

Fix:

✔ Always enter the maker and payee correctly. ✔ Never leave fields blank. ✔ Never rely on whatever the system “guesses.”

Your POS system is capable of detecting fraudulent checks before you cash them. But some MSBs override alerts manually, sometimes losing thousands of dollars.

Fix:

✔ Trust the system.

✔ Never override a fraud alert.

✔ Stop the transaction and ask questions.

Most POS vendors offer:

MSBs are strongly encouraged to schedule additional training with their vendor to learn the system fully.

When MSBs use the POS system properly:

If the system is used upfront, risk drops dramatically and compliance becomes smoother for everyone.

Your POS system can only help you if you use it. By taking advantage of the features you’re already paying for, you’ll reduce risk, increase accuracy, and build a stronger compliance foundation for your business.

At first glance, a checking account is a checking account. Money comes in, money goes out, and you check the balance when you need to. But the day you start running a business, the rules change, because the risk changes. Business accounts aren’t just “bigger” consumer accounts. They typically handle more transactions, more users, more payment types, and more moving parts.

There’s another key difference many owners don’t realize until it’s too late: business accounts generally do not have the same level of consumer protections that consumer (personal) accounts do. When something goes wrong, the process, timelines, and potential liability can look very different. That’s why fraud prevention for businesses isn’t optional. It’s operational.

Consumer (personal) accounts are usually simpler:

Business accounts are different by design:

And because business accounts are treated differently than consumer accounts, the responsibility to monitor activity and catch issues early often rests more heavily on the business.

Most business owners are busy. Delegating bookkeeping is smart, because your time is valuable. But delegation without visibility is where risk grows, especially when one person has end-to-end control.

Internal fraud often looks like:

It’s rarely dramatic at the beginning. It’s usually quiet, incremental, and designed not to be noticed.

Consider Lisa, who owns a growing medical practice. She hired a bookkeeper to “handle the finances” and assumed monthly reports were enough. Lisa rarely reviewed actual transactions unless something felt off.

Over time, the bookkeeper began issuing checks to a vendor that sounded legitimate. The amounts were small—$180 here, $250 there—coded as routine office supplies. The practice was busy, revenue was strong, and nothing looked “wrong” at a high level.

Six months later, Lisa’s accountant flagged unusual expense patterns during a quarterly review. By then, the total loss wasn’t a rounding error. It was meaningful, and the cleanup took time, created stress, and required uncomfortable conversations. The hardest part wasn’t just the money; it was realizing the problem could have been caught early with simple, consistent oversight.

You don’t need to become your own bookkeeper. You just need a rhythm of review that helps you spot unusual activity quickly, especially because business accounts don’t always come with the same consumer-style protections.

Try these straightforward habits:

Strong habits matter, but systems are what help you scale safely. Depending on your business, ask about tools such as:

Surety Bank can help you evaluate which controls fit your operation, set permissions correctly, and implement tools like Positive Pay in a way that’s practical—not burdensome. The goal is to put guardrails in place that make fraud harder to commit and easier to catch, without slowing down your business.

Residential accounts are often simpler and tend to come with broader consumer-style protections. Business accounts operate differently—more volume, more access, more complexity, and often less built-in protection. That’s why vigilance isn’t just a best practice; it’s part of responsible business ownership.

Fraud prevention isn’t about paranoia. It’s about professionalism: review regularly, limit access wisely, and build systems that protect your business long before problems appear.

For cash-heavy businesses, deposit routines are not just an operations detail. They are a security issue, a controls issue, and often a cash-flow issue. When business cash gets deposited “personally,” meaning an owner or employee deposits cash through personal banking habits or into the wrong account, it can blur your recordkeeping and weaken internal controls. The IRS notes it is a good idea to keep separate business and personal accounts because it makes recordkeeping easier. The U.S. Small Business Administration also emphasizes separating funds by using a dedicated business bank account to keep bookkeeping clean and accurate.

Just as important is the security perspective. Regularly sending someone to the bank with cash exposes employees to real risk, and it creates a predictable pattern that can be exploited. The ABA Banking Journal has noted that too many cash-handling touch points, including trips to the bank, increase risk and can put employees in physical danger. Brink’s similarly points out that employees are exposed to theft risk when transporting cash, and that partnering with trained cash logistics professionals can reduce the risk of theft and increase accountability through secure transport procedures.

Some businesses try to replace bank runs with a courier pickup, but not every courier model is designed for cash. Cash transportation is high-risk, and the best solution is typically a purpose-built cash logistics provider whose job is secure cash handling, documentation, and transport. Trained cash logistics professionals and armored services are structured to reduce theft exposure and strengthen chain-of-custody and accountability, which is fundamentally different from general delivery services.

Surety Bank’s Smart Safe is designed specifically for cash-heavy businesses that want stronger security and a cleaner, more reliable deposit process. Surety explains that, through its partnership with Loomis, Smart Safe lets your business deposit cash on-site, receive provisional credit to your Surety Bank account, and eliminate unnecessary bank runs. From a security standpoint, Surety highlights benefits like real-time tracking of deposits, enhanced security for cash and employees, and better accountability with fewer cash shortages.

From a cash-flow standpoint, Surety’s process is built around speed. You enter the amount, deposit the cash into the Smart Safe device, and Surety provides provisional credit to your business account based on that entry. Loomis also describes provisional credit as daily credit for cash deposits without having to go to the bank, reducing time and helping reduce the risk of robbery outside the store.

If your business handles cash, the goal is to reduce handling, reduce trips, and reduce uncertainty. A strong plan usually includes keeping all business cash activity in business accounts and processes with clear documentation and daily reconciliation, minimizing manual bank runs, and using a Smart Safe with a professional cash logistics partner so deposits are tracked and transport is handled by specialists.

Contact our Treasury Services department today to learn how Smart Safe can help you strengthen security, simplify deposits, and improve visibility into your cash.

Adding a new product or service can significantly increase revenue for an MSB. Whether it is money transmission, ATM services, or another offering, early coordination with the bank helps ensure your new service launches smoothly and begins generating income as quickly as possible.

Many service-related delays occur when new offerings are added without notifying the bank in advance.

Each product or service comes with specific monitoring, reporting, and account requirements. The bank must be able to review activity accurately and ensure it aligns with regulatory expectations.

When a new service is launched without notice, activity may flow into the wrong account or lack required reporting. Fixing these issues after the service is live often causes delays or temporary interruptions.

ATM Services

If you are adding an ATM, the bank typically requires:

ATM activity cannot be combined with other MSB transactions due to reconciliation and compliance requirements.

Money Transmission Services

This includes services such as Western Union or other money transfer providers.

While these services may not require a separate account, they do require monthly reporting. At a minimum, reports must include:

These reports allow the bank to identify patterns, monitor risk, and meet regulatory obligations.

Even if a third-party provider has its own compliance program, the bank is still responsible for monitoring the activity flowing through your accounts.

Some MSBs assume that because a vendor manages compliance on their side, the bank does not need reporting. This is a common misconception. Ultimately, the funds flow through the bank, and the bank must conduct its own review.

Failing to provide required reporting can delay approvals, reviews, and future expansion plans.

Adding services often requires:

When these steps are completed in advance, services can go live quickly. When handled after launch, they often result in delays, holds, or additional review.

Growth is a positive step for any MSB. Whether you are adding a new product, service, or location, early communication with the bank helps ensure the process is efficient and compliant.

Starting the conversation early allows the bank to guide you, prepare properly, and help you move forward with fewer obstacles and less frustration.

If expansion is even a possibility, reaching out now can save significant time later.

Opening a new location is an exciting milestone for any MSB. New storefronts mean new customers, increased volume, and business growth. However, opening a new branch also brings additional banking, compliance, and operational requirements that must be completed before you can begin operating.

One of the most common causes of delayed openings is a lack of early or consistent communication with the bank. When the bank is informed early and kept in the loop, the process moves faster and far more smoothly.

From the bank’s perspective, opening a new MSB location is not simply adding another address. There are multiple regulatory, licensing, and operational steps that must be completed before the first transaction can take place.

We often see situations where a customer notifies the bank months in advance, receives a checklist of required items, then communication stops. When the customer reconnects and is ready to open, none of the required steps have been completed. At that point, the bank cannot approve activity, even if the storefront is ready.

Consistent communication ensures both sides stay aligned and prevents last-minute delays.

Depending on the state, services offered, and geographic location, opening a new branch may require:

Even experienced MSBs are sometimes surprised to learn that requirements vary by state and location. A location that works in one market may require different preparation in another.

Many MSBs assume that once a lease is signed and the store is ready, operations can begin immediately. From a banking and regulatory standpoint, this is not always the case.

If required licenses, amendments, or system testing are not completed, the bank cannot allow the location to operate. This is not meant to slow down your business. It is meant to protect both your operation and the bank from compliance violations.

The most efficient openings share a few things in common:

When communication stays consistent, opening timelines are shorter, approvals are smoother, and unexpected delays are far less likely.

When it comes to Money Service Businesses (MSBs), so much of the relationship between the bank and the customer happens behind the scenes through emails, phone calls, documents, and reviews. But sometimes, the most valuable conversations happen face to face.

Recently, Surety Bank conducted a series of on-site visits with MSB customers across Florida. In just two days, our team visited 12 businesses meeting owners where they operate, seeing workflows in real time, and having honest, productive conversations about compliance, fraud prevention, and growth.

The takeaway was clear: on-site visits create clarity, trust, and better outcomes for everyone involved.

From the bank’s side, we review transactions, reports, and data. But that only tells part of the story. Visiting MSBs in person allows us to see how your business actually operates, how customers flow through your store, how decisions are made, and what challenges you face day to day.

For many MSBs, this was the first time they were able to put a face to a name they usually only see in emails or hear on the phone. That alone made a difference. Customers were able to ask questions, share concerns, and better understand why certain compliance requirements exist, not just that they exist.

Site visits also help uncover small issues that can cause big delays later.

During one visit, a customer believed their corporate files were fully up to date. A quick spot check showed otherwise: expired corporate resolutions, missing documentation, and records that hadn’t been refreshed annually as required by Surety Bank policy.

That conversation mattered. Without those documents:

● Checks could be delayed or placed on hold

● Approvals could be paused

● Cash flow could be impacted

Addressing these gaps during a site visit helps MSBs avoid last-minute scrambles, rejected transactions, and unnecessary frustration.

Another consistent theme during site visits was fraud. MSBs are very aware that they are vulnerable and site visits give us the opportunity to talk through practical, preventative steps.

From understanding why certain customers are blocked, to recognizing patterns of suspicious activity, these conversations help MSBs make better decisions before a check is cashed rather than dealing with losses afterward.